Early Look At Transportation Revenue Changes

[10 Minute Read]

As state and local officials passed SIP or stay-home mandates throughout April, many feared the ensuing economic devastation and budget hits to state and local governments.

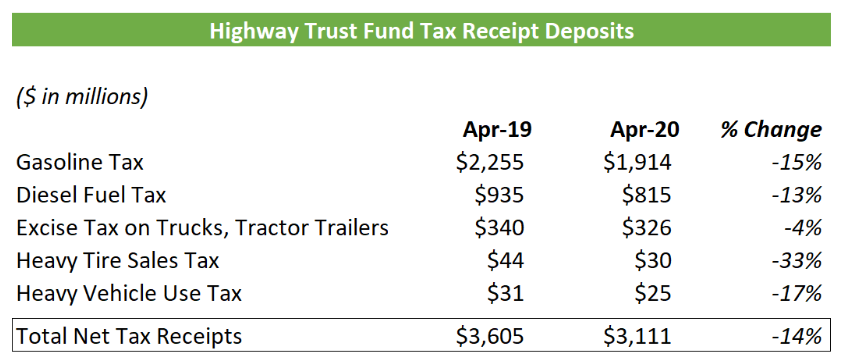

In the recently published April 2020 Federal Highway Trust Fund (HFT) receipts and outlays, we see an early look at fuel tax revenue during recent public health-related lockdown.

Compared to the same period last year, total net tax receipts to the HTF in April 2020 dropped 14% year-over-year, with a 15% drop in gasoline tax receipts. This was a much better-than-expected number, given gasoline consumption has plunged by 30% from pre-COVID levels.

Note: Trust Fund receipts reflect economic activity in the latter half of March plus first half of April 2020

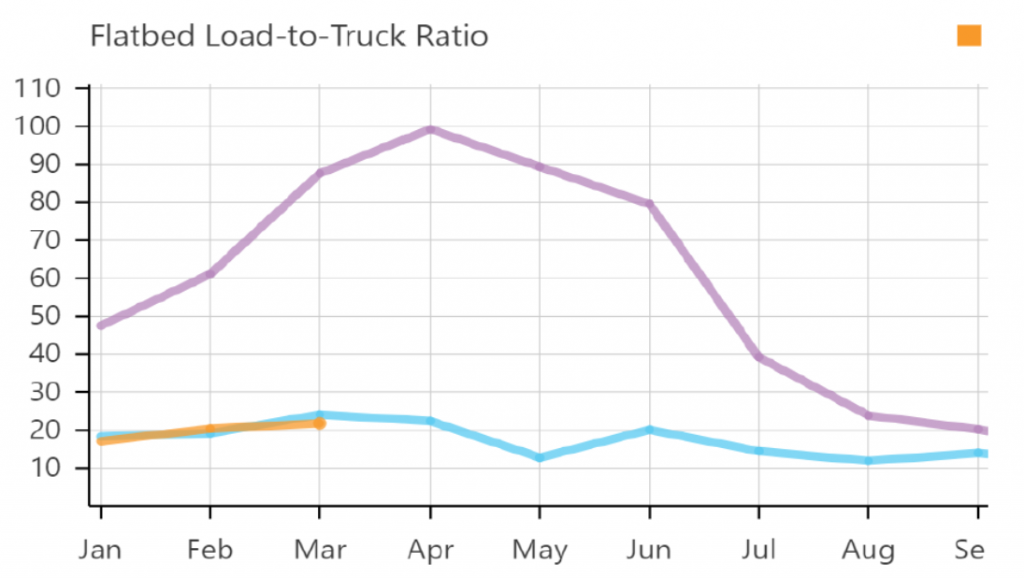

The lower-than-expected reduction in fuel tax receipts may be a result of increased freight truck demand during the early days of the public health crises, as shops and consumers raced to aggressively stock up on goods. Data from the California Truckers Association shows that commercial flatbed load-to-truck ratio saw a spike in the early days of COVID-19 severity:

Since there was more demand for goods (load) than trucks available to transport early on, it may be contributing to better-than-expected fuel tax receipts from the April HFT report.

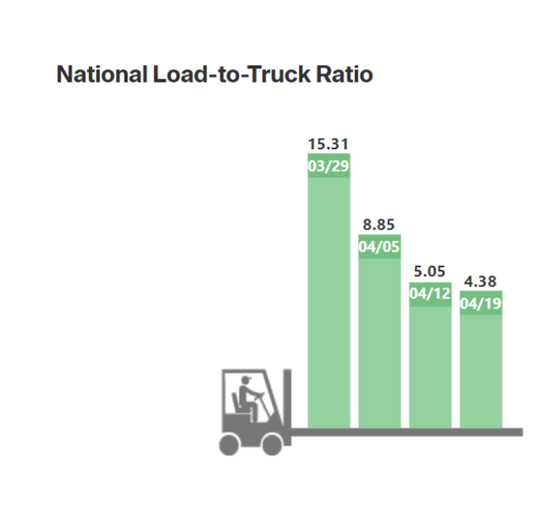

However, as April unfolded, demand for commercial trucking dropped steadily to 4.38 load-to-truck ratio by week of 4/19 – which is 75% lower than the same period in 2019.

Anecdotally, analysts in the trucking industry are seeing a 50% decrease in sales of trucks and tractors, as capital budgets are usually the first to be cut. This would suggest future excise tax receipts on trucks for HFT will likely worsen significantly in the coming months.

Outside of fuel tax revenue, the resilience and impact to other sources of funding for transportation projects will be tested in the coming months. The question of federal assistance for state and local governments is expected to be hotly debated in Congress. The $50 billion in revenue replacement grant requested by AASHTO for state DOTs remains outstanding, as well as transit agencies’ request for a 2nd stimulus aid to replace revenue lost from lower sales taxes.

Meanwhile, the Federal Reserve’s actions to provide liquidity for municipal bonds has temporarily helped stabilize a market frequently tapped by state and local agencies for funding including transportation projects.

New transportation bond issues from Connecticut state and NYC MTA this month will put investor appetite to the test.

As MPOs and state DOTs look ahead to re-forecast fiscal year budgets for capital projects and operating costs, it has become critical to stay nimble with scenario planning for future funds availability for STIP, TIP and CIP plans.

For transportation planners, and leaders at MPO and state DOTs managing against evolving uncertainty – we’d like to share a scenario planning framework we’ve found helpful in weathering past recessions. Our scenarios cover three cases: base, upside and downside.

- Base case – represents your best guess at what will likely happen as of today.

- Upside case – reflects favorable macroeconomic and funding conditions returning much quicker. Performing this exercise helps to identify which transportation projects can be moved forward earlier and which internal efforts should be prioritized – if more funding becomes available, quickly adjusting to play offense to accelerate your agency’s vision.

- Downside case – should reflect a worst-case scenario that goes beyond even the worst of what you can imagine today. While not a pleasant exercise on its own, it forces healthy stakeholder discussions to agree on which projects are candidates for postponement, and how to come up with greater operating efficiencies (however dramatic they may be) should the situation merit it.

Given the multi-variable nature of predicting near-term funding for transportation projects – i.e., speed of control over the public health crisis, federal stimulus, consumer and business sentiment, etc., we recommend revisiting key assumptions in each of the three scenarios on a monthly basis. Additionally, while we never have perfect information before making decisions, it is essential to zone in on the most important, key data points and to keep a close pulse on how they change.

Finally, while how the picture will change for transportation plans like TIP and STIP remains uncertain, what is guaranteed is that more amendments must be processed in the future as the situation evolves.

It is imperative that transportation planning teams revisit how they coordinate amendments and process revisions to ensure they can adapt quickly to unexpected changes by having the right setup and tools for efficient and accurate multi-stakeholder coordination.